The Flexible (Flex) Calendar program allows participating colleges to provide opportunities for professional development in lieu of regular instruction. Flex is directed by the Chancellor's Office as stipulated by Title 5 of the California Code of Regulations.

FAQ

What is Flex?

What is Flex credit?

What is Flex obligation?

What activities count as Flex?

Activities that meet the guidelines of the Chancellor's Office and regulations of Title 5 as related to staff, student, and instructional improvement are considered "Flex". Such activities include, but need not be limited to, the following:

- course instruction and evaluation;

- staff development, in-service training and instructional improvement;

- program and course curriculum or learning resource development and evaluation;

- student personnel services;

- learning resource services;

- related activities such as advising, guidance, orientation, matriculation services, and student, faculty, and staff diversity;

- departmental or division meetings, conferences and workshops, and institutional research;

- other duties as assigned by the district;

- the necessary supporting activities for the above.

See the Guidelines for the Implementation of the Flexible Calendar Program from the Chancellor's Office for a more comprehensive list of the formats and kinds of activities that count as Flex credit.

What is the "Flex Test"?

Generally, activities that meet the "Flex Test" are considered Flex eligible:

- Does the activity contribute to staff, student, and/or instructional improvement?

- Staff improvement – Activities to improve job-related knowledge, skills, or abilities.

- Student improvement – Activities to improve services to students.

- Instructional improvement – Activities to improve teaching and learning.

- Is the activity voluntary and without compensation?

- Voluntary – The activity cannot be required for completion of essential job-related duties and responsibilities.

- Without compensation – The activity cannot provide compensation of any kind, e.g. honoraria, pay advancement, stipend, etc.

- Would the taxpayers approve of this use of funding?

- Public employees – As public employees, we are accountable to the taxpayers. Would the taxpayers approve of their tax dollars being used for this activity instead of regular job-related duties?

- Review/audit – Professional development/Flex Cal reports are records that are subject to review and/or audit by any member of the public until disposal as determined by Title 5 (Section 59025).

If the answers to all of the above questions are affirmative, then the activity may be counted as flex credit.

What to do before work-related travel?

Any employee traveling to a conference, training, workshop, or other work-related event must complete Part I - Request to Attend of the Travel Authorization and Reimbursement Claim (TARC) form at least two weeks prior to registration (four weeks for a cash advance/prepaid expenses). Employees traveling out-of-state must submit forms six weeks in advance of registration.

Employees that plan to apply for professional development funds, request cash advance/prepaid expenses, and/or travel out-of-state must submit forms four to six weeks in advance to allow for processing. Please see the Instructions for Preparation of TARC for details.

Note that California Assembly Bill No. 1887 prohibits state-funded and state-sponsored travel to states with discriminatory laws. Please see the website of the Attorney General for states that are currently subject to California's ban on state-funded and state-sponsored travel: https://oag.ca.gov/ab1887.

What funds are available for professional development?

The Professional Development/Flexible Calendar (PDFC) committee has funds to support employee participation in conferences, workshops, trainings or other professional development activities as related to staff, student, and instructional improvement.

All authorizations for district-related travel must be obtained prior to the time designated for departure. All requests for reimbursement shall be reasonable, and at the lowest rates available, except in extenuating circumstances (AP4480).

Note that California Assembly Bill No. 1887 prohibits state-funded and state-sponsored travel to states with discriminatory laws. Please see the website of the Attorney General for states that are currently subject to California's ban on state-funded and state-sponsored travel: https://oag.ca.gov/ab1887.

What are the criteria for professional development funds?

The PDFC complies with Article 5 [81750-87154] of California Education Code stating authorized uses of funds shall include all of the following:

- Improvement of teaching;

- Maintenance of current academic and technical knowledge and skills;

- In-service training for vocational education and employment preparation programs;

- Retraining to meet changing institutional needs;

- Intersegmental exchange programs;

- Development of innovations in instructional and administrative techniques and program effectiveness;

- Computer and technological proficiency programs;

- Courses and training implementing affirmative action and upward mobility programs; and

- Other activities determined to be related to educational and professional development pursuant to criteria established by the Board of Governors of the California Community Colleges, including, but not necessarily limited to, programs designed to develop self-esteem.

Events that do not meet one or more of the above criteria are not eligible for professional development funds.

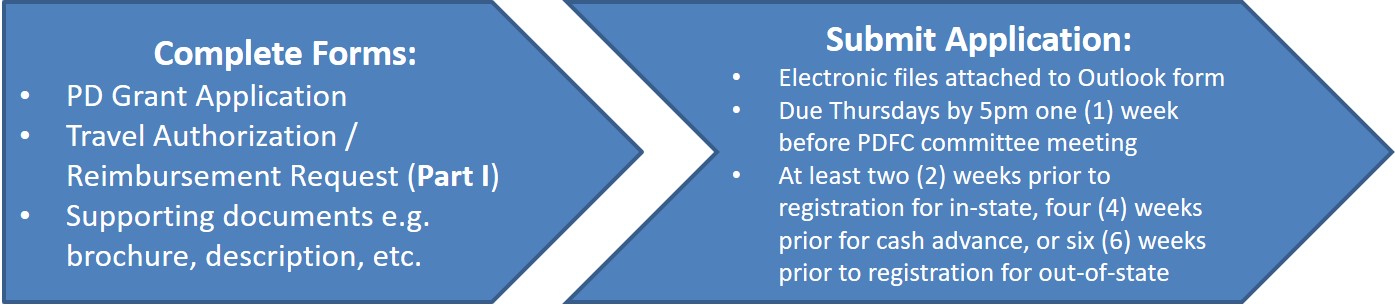

How to apply for professional development funds?

Employees that plan to participate in a professional development event that meets the above criteria may apply for funds by completing the following:

- Travel Authorization and Reimbursement Claim - Part I - Request to participate

- Include copies of estimates for allowable expenses

- Add per diem for meals not provided by event

- Sign and date

- Obtain supervisor's signature and date

- Professional Development Grant Application

- Provide a description explaining how the activity meets the criteria for professional development funds

- Attach a descriptive brochure of the activity schedule with relevant information (e.g. date[s], location, etc.)

- Indicate the total amount requested

- Sign and date

- Checklist

- Ensure that all forms and supporting documents are included in the application packet

Upload documents as attachments to the Outlook form while logged in to Outlook. Individuals that apply for more than one grant per academic year are required to address the supplemental questions (here). Note the due dates on the Committee Info page. Please see the Professional Development Grant Procedures for more information.

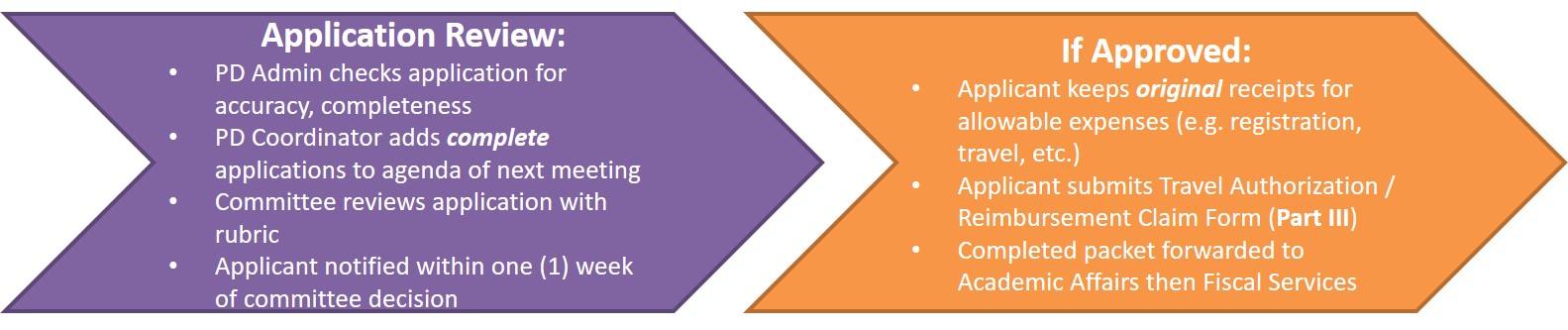

What happens to professional development funds applications after submission?

First, Professional Development (PD) application packets are checked for completeness. Application packets are not forwarded to the PDFC committee until complete. The PD Administrative Staff requests missing forms or documents from applicants as necessary.

Second, completed PD application packets are forwarded to the Professional Development Coordinator. Applicants names are added to the agenda for the upcoming PDFC committee meeting (see Committee Page for meeting dates and agendas).

Next, the PDFC committee evaluates PD application packets using a standard rubric as time allows (maximum 30 minutes per meeting). Reviewed applications may be approved, returned for additional information, or denied. Any remaining applications are carried forward to the next committee meeting (see Committee Page for meeting dates and agendas).

Lastly, the Professional Development Coordinator notifies applicants of the outcome of their application within one week of the committee decision. Application packets are returned to the PD Administrative Staff for processing.

What expenses are allowable for professional development funds?

Allowable expenses are indicated on the Travel Authorization and Reimbursement Claim form. Please review this form carefully for specific information. Generally, professional development funds may be used for transportation (to and from the event), lodging (if necessary), registration (not including a membership fee), meals (if not covered by registration) and other expenses (e.g. parking fees, bridge tolls, etc.).

All authorizations for district-related travel must be obtained prior to the time designated for departure. All requests for reimbursement shall be reasonable, and at the lowest rates available, except in extenuating circumstances (AP4480).

Note that California Assembly Bill No. 1887 prohibits state-funded and state-sponsored travel to states with discriminatory laws. Please see the website of the Attorney General for states that are currently subject to California's ban on state-funded and state-sponsored travel: https://oag.ca.gov/ab1887.

How to calculate expenses for mileage and/or meals?

Expenses for mileage and meals are based on standard rates as issued by the Internal Revenue Service (IRS):

|

Rate |

Jul 1-Dec 31, 2022 |

Jan 1 2023 - |

|

Mileage |

$0.625 per mile |

$0.655 per mile |

If travel is outside District boundaries, the District may provide an allowance for meals starting with the time of departure. Expenses for meals are based on the location of the conference/activity and shall not exceed the amounts established by the U.S. General Services Administration.

How to get cash advance/prepaid expenses?

How to get reimbursed for allowable expenses?

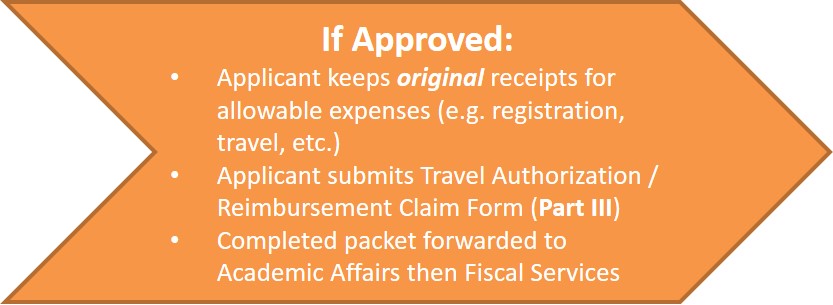

If your application is approved for funding by the PDFC committee, then you are eligible for reimbursement of allowable expenses. Complete Part III - Request for Reimbursement of the Travel Authorization and Reimbursement Claim (TARC) form. Submit the completed TARC form with original receipts to the PD Administrative Staff within seven (7) calendar days of return from authorized travel. The Vice President of Academic Affairs reviews all documentation. Once approved by the VPAA, the forms are forwarded to Fiscal Services for review. Reimbursement checks arrive by mail unless arranged otherwise.